As I write this, WTI is trading at $46.40. Brent is at $49, and wholesale gasoline is selling for $1.56.

This is a far cry from the fears a few weeks ago that we were going to retest that low around $28 a barrel set in 2016.

No, the support line above $42 has held, and the price of crude has bounced as the shorts took it on the chin.

I think it was the great investor Warren Buffett who said, “Find the lie in the market and exploit it.” Right now, the oil market is overwhelmingly short because it believes these five lies.

Top Five Lies of the Oil Market

- OPEC won’t hold together. Members will cheat and over-produce, despite rhetoric to the contrary.

- The U.S. shale patch will continue to cut costs and increase efficiency to make money regardless of the oil price.

- Capital spending on new oil projects is robust.

- We are awash in oil as stockpiles remain high.

- Demand will remain flat.

All five of these assumptions are wrong.

The Oily Truth

1. Saudi Arabia is in trouble. For starters, it is losing a costly war in Yemen, and foreign currency reserves dipped below $500 billion in May. The Kingdom needs money to pay for its social programs and has a desperate need to list its national oil company, Aramco, on a major stock market with an initial public offering (IPO).

This will happen in about nine months, and it could be valued at $2 trillion. That’s a crazy number and more than twice the value of any public company on Earth.

To get this value, the Saudis need oil above $75 a barrel and would be ecstatic with $100 a barrel. Don’t think they won’t jack up oil prices.

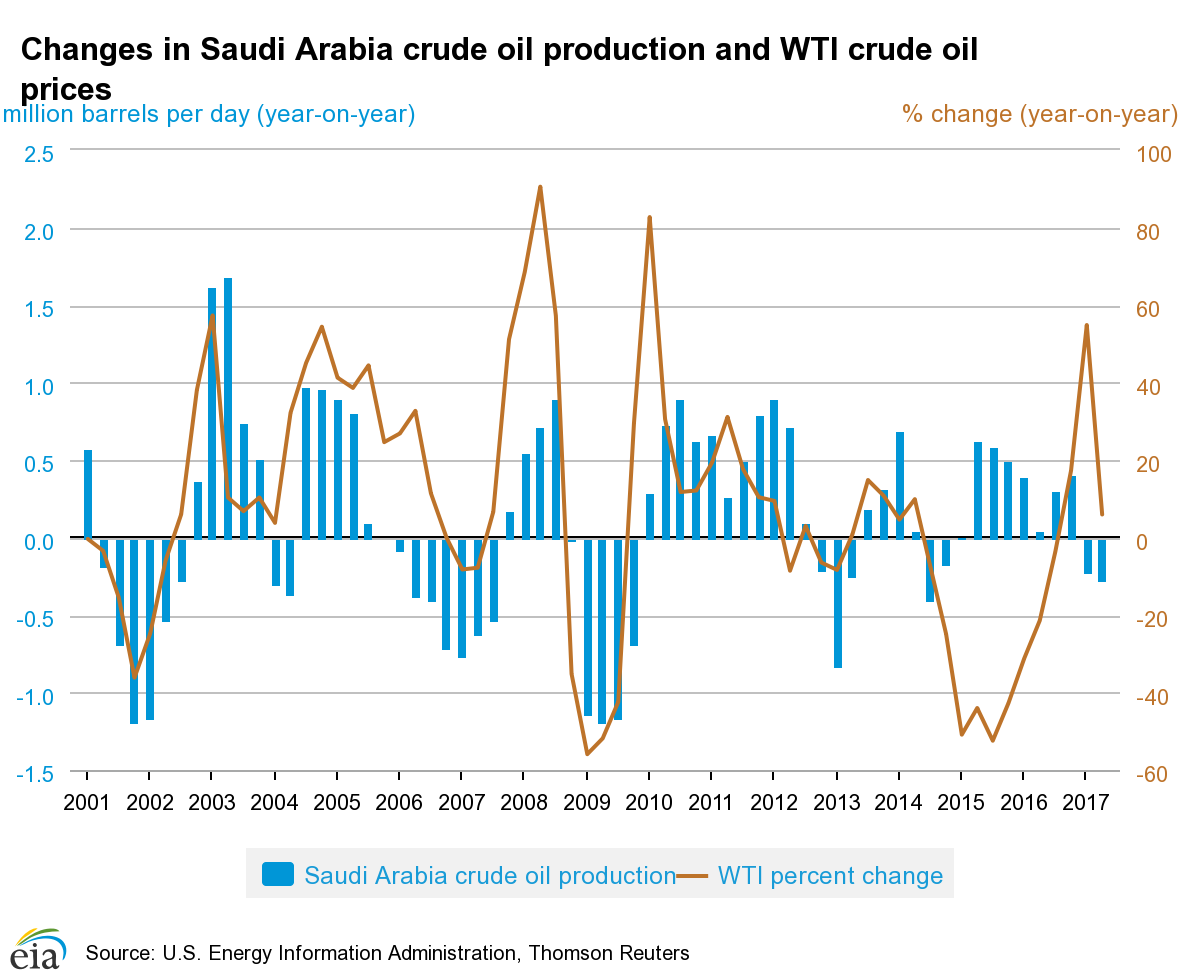

In the past 17 years, the Saudis have slashed oil production by more than 2.5 million barrels a day three times. The last time they got serious, in 2009, oil went from $50 to $120 a barrel.

As you can see by the above chart, the Saudis aren’t quite at the serious stage (the blue bars). But my bet is they will get there before the Aramco IPO.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

2. The U.S. shale patch has turned. Fracking wells run out faster than traditional wells, with an average lifespan of eight years and significant output decline after the first three years.

It should be noted that the hockey stick of tight well production started seven years ago in 2011, and most projections show production leveling off going forward.

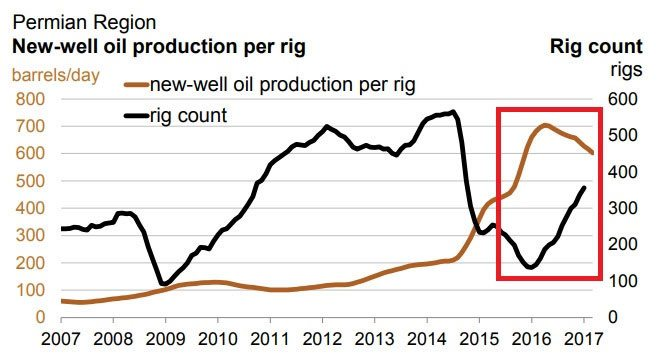

The Permian Basin has been a bellwether for the fracking industry. It has the most oil and lowest cost of production. However, numbers put out last week suggest the tide has turned. The rig count is up, but the oil production per rig is down. This chart shows that the idea of ever-increasing efficiency in the shale patch is a lie.

3. Global crude oil discoveries are at a record low. Conventional crude oil discoveries totaled just 2.4 billion barrels in 2016, versus the average of 9 billion barrels in the last 15 years, according to the IEA. Furthermore, firms have slashed spending on exploration by $1 trillion. This is the lowest number of projects since the 1940s. It takes years to get a conventional oil well up and running.

4. Oil reserves are dropping. Last week, EIA data showed U.S. crude stockpiles slid by 7.56 million barrels, the biggest decline since September. Gasoline supplies fell for a fourth straight week, tumbling to the lowest level since December. It was the biggest inventory reduction in 10 months, and stockpiles are now below the 500 million barrel mark.

5. Global oil demand is relentlessly growing. In 2012, global oil demand was at 90 million barrels a day. By the third quarter of 2018, it will cross 100 million barrels a day. India, Brazil, and Argentina are back to positive growth. China just beat expectations with a 6.9% GDP number today. The EU just put out its best GDP number in six years. Demand has plenty of upside.

If you believe in the bullish oil story, you should check out this one company I found that is fracking in Mexico. It’s like investing in the Bakken 10 years ago. It trades at $0.27 but won’t for long. It is already starting to move. Click here now.

All the best,

Christian DeHaemer

Christian is the founder of Bull and Bust Report and an editor at Energy and Capital. For more on Christian, see his editor’s page.